-

solutinos

-

Hire

Frontend Developer

Backend Developer

-

NodeJS Developer

-

Java Developer

-

Django Developer

-

Spring Boot Developer

-

Python Developer

-

Golang Developer

-

Ruby on Rails Developer

-

Laravel Developer

-

.NET Developer

Technology

-

Flutter Developer

-

React Native Developer

-

Xamarin Developer

-

Kotlin Developer

-

Cross-Platform Developer

-

Swift Developer

-

MongoDB Developer

-

C Developer

-

Smart Contract Developers

Cloud

-

-

Services

Mobile Development

Web Development

- Work

-

Multi Services App

-

Food Delivery App

-

Grocery Delivery App

-

Taxi Cab Booking App

-

Multi Services App

-

OTT Platform APP

-

Social Media APP

-

Freelance Service App

-

Car Rental App

-

Medicine Delivery App

-

Liquor Delivery App

-

Sports Betting App

-

Online Coupon App

-

eLearning App

-

Logistics & Transportation App

-

Courier Delivery App

-

On-Demand Real Estate App

-

E-Wallet APP

-

Online Dating App

-

Handyman Services App

-

-

Process

-

Company

Quick Summary : This guide aims to help you clearly understand software development capitalization, including the key concepts, advantages and disadvantages, and tips on how to apply it correctly. Learn how to navigate the complexities of capitalizing software development costs to optimize your financial strategy.

Capitalize Software Development

Capitalized software costs are recognized as assets in the balance sheet rather than charged completely in the profit and loss statement for the period. This approach distributes the costs out over the life of the software, usually by using an amortization schedule.

Software development is a lucrative area to invest in, as it helps enhance financial reporting and strengthens a company’s balance sheet. The software market size worldwide is estimated to reach $898.90B by 2029 due to high custom software product development and efforts towards implementing the agile methodology.

This blog will discuss why software development should be capitalized, its effects on financial statements, and the market opportunities, thus assisting decision-making in software investments.

Why Capitalize Software Development

Capitalizing on software development enables businesses to capitalize on the costs of developing certain software by writing them down as assets. The expenses are taken through an amortization process over the useful life of the developed software. It increases the credibility of financial reporting by reducing fluctuations in the profit margin and improving the overall balance sheet. It also preserves retained earnings that distance the firm from the risks of loss, making it more eligible for investor and lender consideration. The capitalization of development costs enables businesses to plan and implement their software development budget efficiently while ensuring long-term growth on their balance sheets, thus enhancing the chances of enterprises to improve their asset worth and gain more financial and strategic agility in their operations.

Rules for Software Development Capitalization

Accurately capitalizing on software development costs is essential for proper financial reporting in a software development business. In the United States, the specific key software development capitalization rules are issued by the Financial Accounting Standard Board (FASB) under the Securities and Exchange Commission (SEC) microscope under the Accounting Standards Codification (ASC) 350-40 for internal use software and ASC 985-20 for software for sale.

Technological Feasibility

Technological feasibility is usually in the life cycle of a business when the business entity can prove the viability of developing the software usually after detailed design, planning, and at least the coding phase. Any expenditure for the project before this stage of development is not capitalisable and requires expenses including research and preliminary project costs.

Development Stage Costs

Only costs incurred during the application development stage qualify for capitalization. This includes direct costs related to coding, testing, and labor. For internally developed software capitalization, it's important to differentiate between these capitalizable costs and those that should be expensed, such as training and maintenance, which occur post-implementation.

Intended Use

The software must be intended for internal use or sale. The software development capitalization rules differ based on this intended use. It means that the development costs of an application for internal use only may be capitalized while for an application marketed to other users other conditions like an application is ready for general release must be met.

Amortization of Capitalized Costs

Once the software has been put into operation, the expenditure must be depreciated, in the same manner as other tangible assets, over three to five years. This guarantees that cost recognition corresponds with the revenues from the software.

Documentation and Compliance

Adherence to software development capitalization rules requires detailed documentation of all capitalizable costs, the point of technological feasibility, and the rationale for the selected amortization period.

Benefits of Capitalizing Software Development

Capitalizing on software development costs offers several strategic benefits that can greatly enhance a software development company's financial stability and growth potential. By capitalizing internally developed software, businesses can optimize their financial reporting and long-term planning. The following are the Benefits of Software Capitalization:

Reduced Expense Impact

When a software development company decides to legally capitalize software development costs, then instead of expunging all or most of the costs within the first year, it recognizes these costs over the useful life of the software product. This approach softens the negative effect on the company’s earnings, thus attaining a more agreeable cost structure and less erratic earnings in the future.

Preserve Retained Earnings

A company can preserve its retained earnings by capitalizing on software development costs. Instead of seeing a significant reduction in earnings due to large one-time expenses, the company amortizes these costs gradually. This helps maintain a stronger balance sheet to attract investors and support long-term growth.

Easier Funding

Many investors are willing to fund software development because it can be capitalized to make it easier for a company to access capital. Upon capitalization, the costs are reflected under assets in the balance sheet and thus an addition to the total asset base. This can make the company more appealing to financiers and investors because it exhibits strategic, income-generating fixed assets.

Strategic Flexibility

Software development capitalization means a company can take on bigger, more complex projects without causing an immediate financial drop. Capitalizing the software development budget allows a capital software developer to engage in selected programs deemed critical to the next generation's competitiveness and growth. This flexibility enables businesses to innovate and expand without compromising short-term financial stability.

Want to learn more about capitalizing software development?

Connect with us Connect with usChallenges in Software Development Capitalization

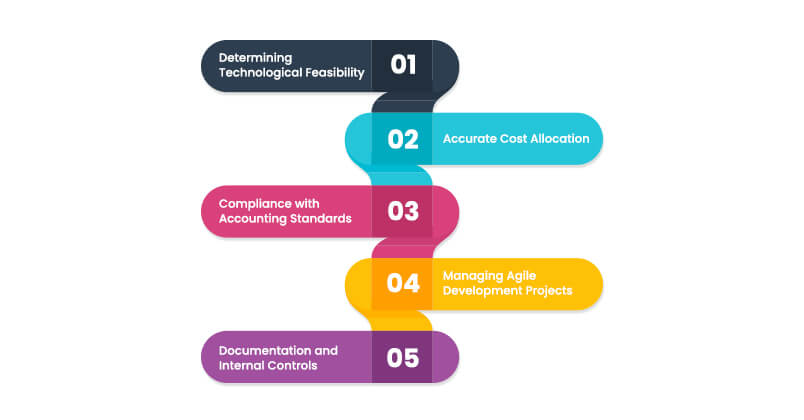

The capitalization of software development costs can be described as intricate and poses several areas of concern that every company needs to observe and meet relevant regulations. It is important to comprehend these issues as organizations scale implement agile practices and navigate complex software initiatives. Here are some software capitalization challenges:

Determining Technological Feasibility

One of the primary challenges in software capitalization is accurately determining when a project has reached technological feasibility. This milestone is crucial because costs incurred before this point cannot be capitalized. In traditional development, technological feasibility is generally easier to define; however, in agile software development capitalization, where projects evolve iteratively, pinpointing this stage becomes more challenging. Agile development often involves frequent changes and updates, making it difficult to determine when a project is technically feasible and ready for capitalization.

Accurate Cost Allocation

Some of the costs that can be capitalized include development and coding, while expenses relating to research, planning, and after-implementation are expensed. Efficient resource costing involves careful planning and documentation processes to meet accounting standards. This can be particularly challenging in complex projects where various cost elements overlap and require detailed segregation.

Compliance with Accounting Standards

Adherence to specific accounting standards like ASC 350-40 and ASC 985-20 is usually complex. These standards present concrete rules for capitalizing software development costs, including what it means for capitalized costs during development and which prices are allowable to capitalize. Maintaining the standards of these considerations, as they change over time, demands constant focus and awareness. This may result in misinformation of financial statements and possibly regulatory problems.

Managing Agile Development Projects

Agile software development creates specific difficulties for the software capitalization concept because of its nature. In general, agile project characteristics are flexibility and frequent updates, which may cause problems when deciding whether costs should be capitalized. The dynamic nature of agile development means that traditional capitalization methods may need to be adapted, requiring close collaboration between development and finance teams to manage and document costs effectively.

Documentation and Internal Controls

Maintaining thorough documentation and robust internal controls is essential for supporting software capitalization decisions. Lack of sufficient documentation and a poor internal control system put the company at risk of an imbalance in capitalized costs and regulatory problems. Proper records management and internal controls have been implemented to help the organization track capitalization practices that meet architectural accounting standards.

Capitalizing Software Development Costs

Capitalizing software development costs is a robust financial strategy used to allocate the costs of developing software across its usefulness period rather than having to write these costs off in the first accounting period. This method can significantly impact financial health and improve software development funding opportunities.

Understanding Software Development Cost Estimation

Accurate software development cost estimation is crucial for effective capitalization. This process involves identifying which costs can be capitalized—typically those related to the application development stage, such as coding, testing, and direct labor. Expenses incurred during the research, planning, and post-implementation stages, such as training and maintenance, are generally expensed as incurred. Proper cost estimation helps ensure that only the appropriate expenses are capitalized, leading to more accurate financial reporting.

Impact on Financial Statements

By capitalizing on software development costs, companies can enhance their balance sheets. This approach is perceived as preferable to having a large one-time expense eat into the net income while the costs are reported as an asset where they are spread over the useful life of the software, which is normally between three to five years. It leads to lower fluctuation of expenses and may positively affect the profit, albeit temporarily. From the perspective of companies interested in software development funding, this stability may positively influence investors and creditors, as it indicates a continuous orientation to accumulating valuable and profitable capital assets.

Strategic Funding and Investment

Capitalizing on software development costs also opens up strategic funding opportunities. Through enhanced balance sheets and expense control, interested Companies are in a better place to access funding for future and ongoing projects. This method of financing shows potential investors that the company is looking into the future, showing it is a better investment than other prospects.

Capital vs Expense Software Development: Key Differences

It is important to distinguish between capital vs expense software development for effective financial reporting. Capitalized development costs are considered an asset that can spread over the software's life for three to five years. This approach increases cost in the long term thus improving the firm’s balance sheet and providing better cash flow prediction.

On the other hand, when the software development costs are expensed, they are taken straight to the income statement as an expense. This approach can significantly reduce net income in the short term, as the entire cost simultaneously impacts the financial statements.

The decision between capitalizing and expensing depends on factors like the development stage and the intended use of the software. Capitalizing is generally applied when the software is expected to provide long-term benefits, while expensing is used for costs incurred during the research or maintenance phases.

Conclusion

So, What is capitalized software? It is essential to understand. How to capitalize software development? It can significantly impact your business's financial health. Capitalizing development costs helps spread expenses over time, improving your balance sheet and offering a clearer view of your profitability. This strategy stabilizes your financial reporting and enhances your ability to attract investment and secure funding. As the software market grows, effectively capitalizing on development costs will be crucial for long-term success and stability. By mastering these practices, you can ensure your business remains competitive and financially robust in an evolving industry.