-

solutinos

-

Hire

Frontend Developer

Backend Developer

-

NodeJS Developer

-

Java Developer

-

Django Developer

-

Spring Boot Developer

-

Python Developer

-

Golang Developer

-

Ruby on Rails Developer

-

Laravel Developer

-

.NET Developer

Technology

-

Flutter Developer

-

React Native Developer

-

Xamarin Developer

-

Kotlin Developer

-

Cross-Platform Developer

-

Swift Developer

-

MongoDB Developer

-

C Developer

-

Smart Contract Developers

Cloud

-

-

Services

Mobile Development

Web Development

- Work

-

Multi Services App

-

Food Delivery App

-

Grocery Delivery App

-

Taxi Cab Booking App

-

Multi Services App

-

OTT Platform APP

-

Social Media APP

-

Freelance Service App

-

Car Rental App

-

Medicine Delivery App

-

Liquor Delivery App

-

Sports Betting App

-

Online Coupon App

-

eLearning App

-

Logistics & Transportation App

-

Courier Delivery App

-

On-Demand Real Estate App

-

E-Wallet APP

-

Online Dating App

-

Handyman Services App

-

-

Process

-

Company

What is Fintech?

Fintech is the appealing new age word for anything that has to do something with finance and technology.

Currently, it has become omnipresent. Consciously or unconsciously, we are using it more often than we know. Using virtual cards on our smartphones, withdrawing cash from ATMs, or performing mobile payments, we participate in dimensions of Fintech.

Fintech market: A glimpse

Fintech is all-pervasive, and there are many reasons for it. Out of all, the closest relationship of human lives with money stands out.

The Fintech market covers widespread areas. They can be as follows:

- payments

- lending

- insurance

- personal finance

- money transfer

- crypto-based solutions

- mortgaging

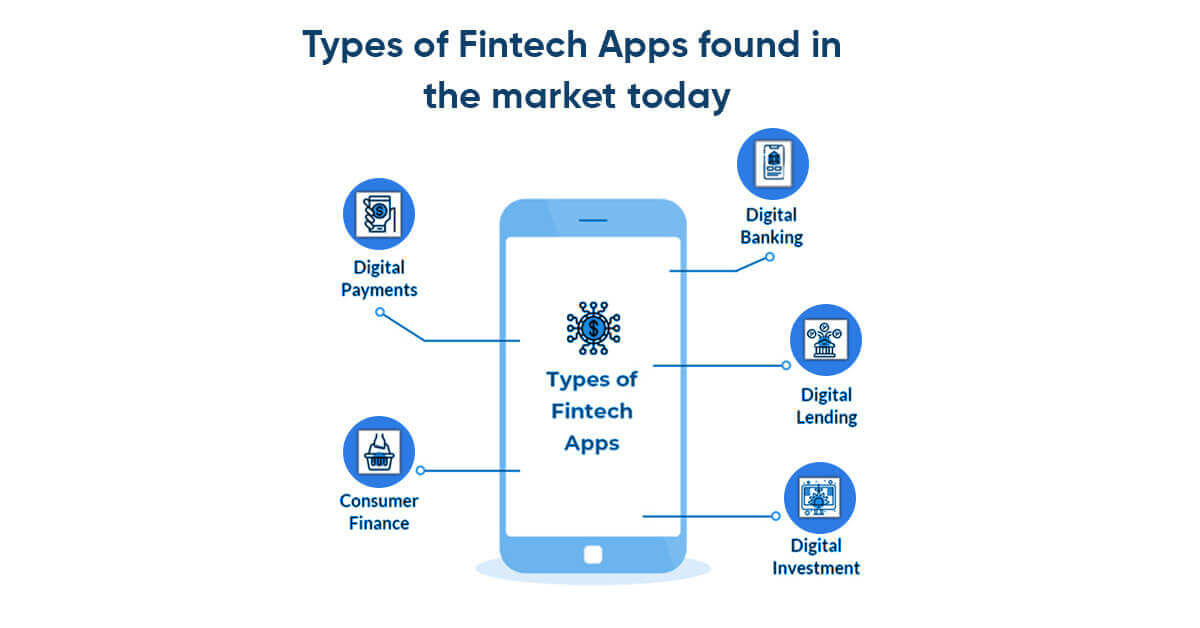

Types of Fintech apps

Fintech apps could be of various types depending on the area of finance they deal with. You can choose from digital payments to consumer finance or digital lending and much more; all this depends on your needs.

Digital Payments

when payments are made in a cashless manner, quickly and securely, it is called digital payment.

Fintech apps consisting of online payment systems, e-wallets, or digital currencies ease digital payments.

It is one of the protuberant branches of financial technology. Statistics optimistically suggest that its value will increase multifold soon.

Examples of this could be Fintech app development companies like PayPal, Paytm, and many more.

Digital Banking

Banking is one of the strong pillars of the economy. For banking to be more convenient, inclusive, and fast, digital banking is the solution. Through this, the bank can manage the data, and customers can manage their bank accounts, both with minor inconvenience. It’s here that banking mobile apps are sought-after.

Digital Wallet

it’s software that enables its users to store their funds online and make and receive payments.

One example of it could be the Fintech app development company Google Pay.

Digital Lending

Fintech apps provide a platform to lenders and borrowers online for them to interact with each other, simplify procedures and efficiently manage them.

Digital Investment

when it comes to digital investment, Fintech apps provide sagacious data concerning where and how to invest in the financial market or trading; so that customers can make informed decisions without involving intermediaries.

Insurance Apps

Fintech paces up the issuance of insurance policies, eases the handling of customer claims, and reduces the rate of customer fraud. All this results in coherent customer and agent interaction.

Cryptocurrency Apps

We see remarkable divergence and interest in investing in virtual currencies. Crypto, although in the developing stage, is a craze. Due to this rapid crypto adoption, crypto apps are increasing in number and popularity. Examples of it are CoinDCX and CoinSwitch.

Neobanks

neo-banks are apps that provide users with digital banking services like transferring money, and making payments, without the need to visit physical branches.

They partner with traditional banks to provide services. Here, we see banking mobile apps like Razorpay X as a popular neo-bank in India.

Personal Finance Management Apps

these apps allow users to track their finances, i.e., income and expenditure, by recording them in convenient groups like food, transportation, etc. It terminates the use of physical notebooks. They offer user-friendly tools which ease up the convenience of customers.

Why pursue Fintech app development

Rising Financial Illiterancy

With digitization in every nook and corner, one might think that people today are more aware of the domain of finance. But this is not true. In 2015, a survey conducted by S&P survey showed that more than half of Americans were financially illiterate. Also, this has increased when compared to former years. The fact that this ignorance is more among millennials is three fourth, is dismal.

So, building a Fintech app, that caters to the needs of such people, making finance an easy task for them, and helping them take control of their finances, will be hitting gold.

Increased Number of Cell Phones

There are approximately 6.8 billion smartphone users. Statistics suggest smartphone penetration of over 80%. As more people have access to smartphones, developing Fintech apps will facilitate financial inclusion and better access due to a large market of users. Possibilities are endless, and one needs to do a lot.

If we take the example of home rental management, an app could provide solutions amalgamating options like tenant screening, rent collection, and management.

Open Banking

since the early days, we need to go to the bank to access banking services. But times have changed now. Now, the bank comes to people digitally. The driver behind this concept is open banking. Interconnectedness is the key; expedited by Fintech. Today one can easily build and reply to complex Fintech solutions without going through the cumbersome process of lengthy certifications or development to manage financial data directly. The possibilities are endless.

The must-have features of a Fintech app

Simplicity

Fintech apps consist of some important information. Thus, to enable a hassle-free experience, the process of Fintech app development must be simple and easy.

It will allow the app to retain its customers longer.

Sign Up & Sign In

one of the features a Fintech app can't do away with is account registration, be it any kind of Fintech app be it a digital banking app or shopping app from the customer side, it's vital to protect their registration and login via 2-factor authentication or touch or face ID.

Security

it is indispensable for a Fintech app to safeguard sensitive customers’ financial information. For this, the developer implements blockchain, encryption, two-factor authentication, and touch or face ID. Multi-layered security features are added to the app, during the Fintech app development depending on the type of app.

Paymeny Gateway

he majority of Fintech apps have to do with payments. So, it is a prerequisite to integrate a payment gateway, enhance convenience, and make transfers on the platform. For this, one can choose to integrate with services like PayPal, Zelle, or via bank APIs.

Push Notifications

For any app to stand out, one of the most vital factors is communication. Push notifications are one of the relevant features as it provides a channel for effective communication among bank officials and customers. They also provide regular updates and keep users informed on time. Also, notify users of payment channels or inform them of any special offers.

Personalization

pairing the Fintech app with artificial intelligence, makes personalization an added feature. AI scrutinizes users’ patterns and behavior and allows them to customize the app according to their preferences. The options include dashboard settings, changing the font size, dark or light theme, etc. This helps in client retention and attracts new customers.

Dashboard

It’s almost impossible to visualize an app without a dashboard. The dashboard provides a convenient platform to display many required tools and mandatory pieces of information.

Mchine learning

Today, AI is not an extra feature, but a necessity in Fintech apps. Machine learning algorithm draws data from different inputs, analyzes it, and provides required advice.

QR Code Scanning

This attribute of QR code scanning makes interaction with the application uncomplicated. A lot number of transfers via QR codes concluded nowadays.

Steps to Create a Fintech app

It is time to walk through the strategy of pursuing Fintech app development. Below is a step-by-step guide for developing a booming financial app.

Choose Your App Type

Firstly, choose the niche for which you want to create the software. Whether it is an online banking app, or q shopping app, or a payment app? After that, probe into your target audience and direct competitors according to the type of application you are building

Gather a Dedicated Team

After finalizing the idea, choose a dedicated team of experts. They will chalk in the plan as to how to implement the visualization.

One can choose any model of cooperation depending on your requirement. You can choose an in-house team, outsource, or hire individual freelancers.

Research the Market

Now, comes the task of a business analyst who will pinpoint the market, analyze the competitors, and determine the target audience. Finally, chart out a vision for your app, and accentuate your strengths.

Ensure Regulatory Compliance

A Fintech app contains sensitive customer data, which needs to be protected. Therefore, it's vital to ensure that the app complies with the regulator norms of the land. There are regulatory and data protection laws that mandate compliance. Fundamentally, understand the legal agreements associated with accessing a user's financial data. After that, create a data privacy policy. Also, have an insurance policy to protect yourself in case of a breach.

Define Your App’s Features

Now it is time to ponder the app features, which surely will be the highlights. It is preferential to start with the most important and then add on to the mess important ones. One should always leave the scope of adding additional functionality in case a need arises.

Start Your UX/UI Design Process

We have already talked about how personalization is one of the intrinsic features of the app.

Now is the time to start working on the visual aspect of the app. Start with conducting UX research. It will help create a user-friendly interface. It is always good to know what appeals to and attracts customers, to ensure their retention for a long period.

Develop Your App

Once the app design is ready, one can start working on developing the technical part of the process. It will enable receiving a working minimum viable product.

Test Your App

Before launching Fintech, it is essential to verify that the app is free of bugs and works appropriately. It is here that QA specialist will show their expertise and will fix complications if any.

Launch Your App

Once the Fintech app is adjusted just right, it is ready to launch in the market. After the launch, one must be willing to receive feedback and correct oneself, to upgrade the app.

Fintech app development: Tracing the Trends

Now, let us identify the trends on the path of Fintech app development. Some of the Fintech app development trends can be enumerated as:

Blockchain Technology

Blockchain technology refers to an advanced database mechanism, that allows transparent information sharing, consisting of an immutable 'chain of blocks'. It is a decentralized ledger, resulting in it being highly secure, assuring users of their privacy and security. Blockchain transactions, thus, are more reliable and transparent.

Artificial Intelligence (AI)

Artificial intelligence is the imitation of human intelligence using machines, especially computers. It traces input data patterns and scrutinizes them. Fintech apps based on AI will be comparatively better at detecting fraud. Also, help develop better-personalized experiences; ultimately increasing profitability.

Conclusion

Alan Kay, an American computer scientist, remarks that the best way to predict the future is to create it. The Fintech market today is thriving at unparalleled speed. And as more and more people opt for digital financial services, we expect it to grow more. No time could be righter than now to venture into the business of Fintech app development. Fintech indisputably will be the future of finance. Thus, it is crucial to ensure that Fintech app development is accomplished efficaciously to provide high-quality functionality.